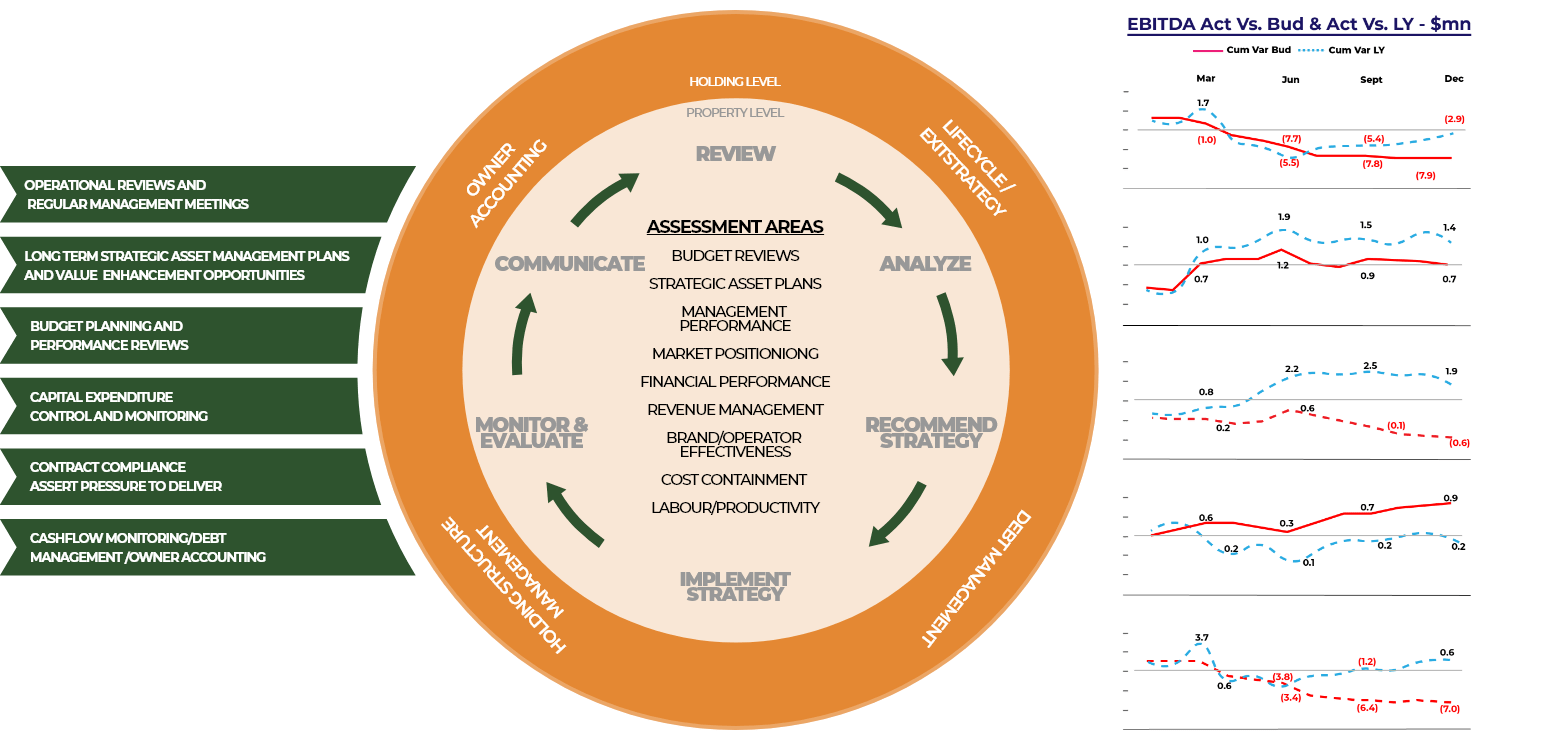

At MEREHA we provide a unique blend of diversified and in-depth hospitality expertise following management experience with leading hotel management groups, development companies and asset owners that allows us to understand the business from all stakeholder angles.

1 Strategic Advisory

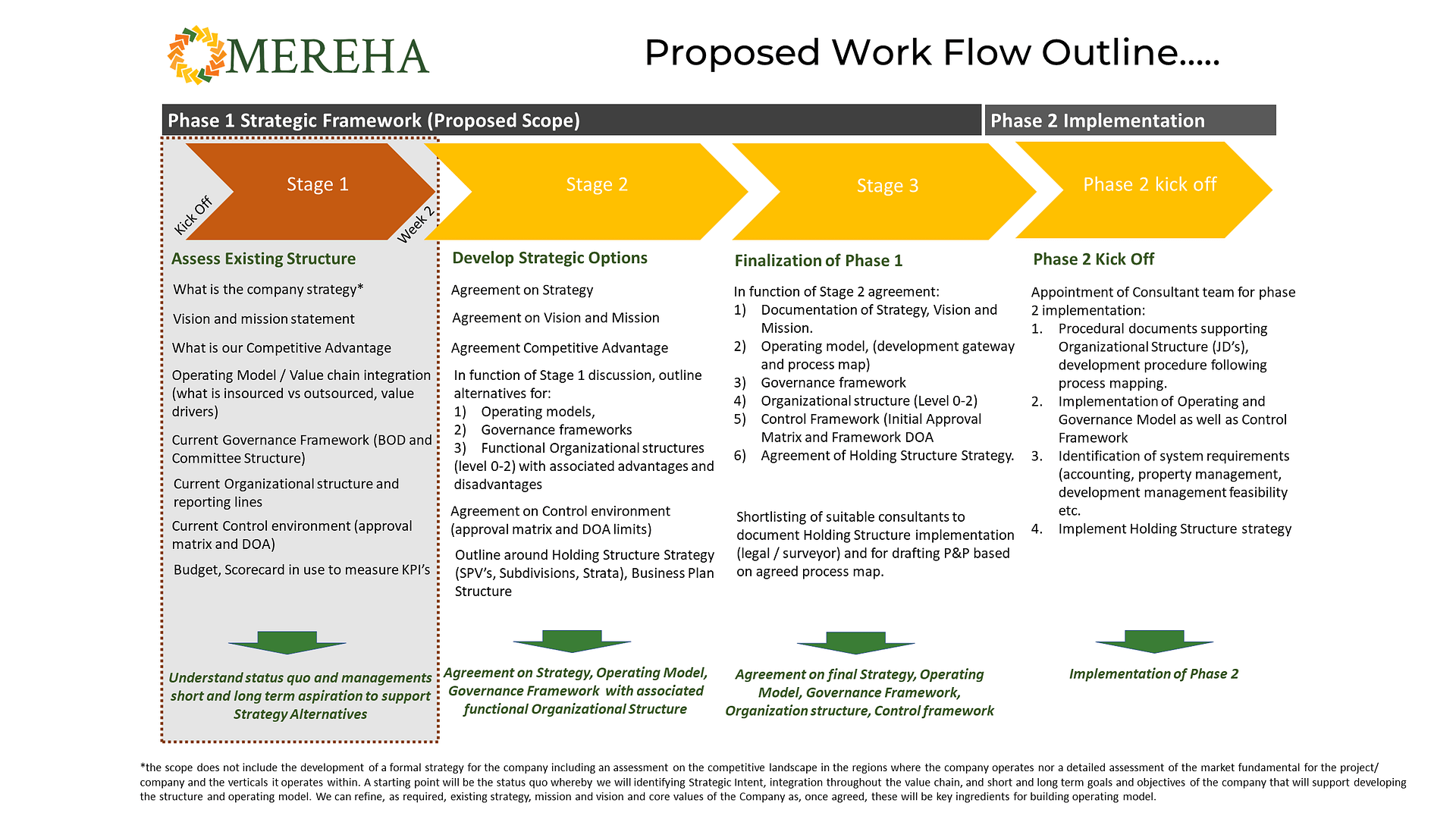

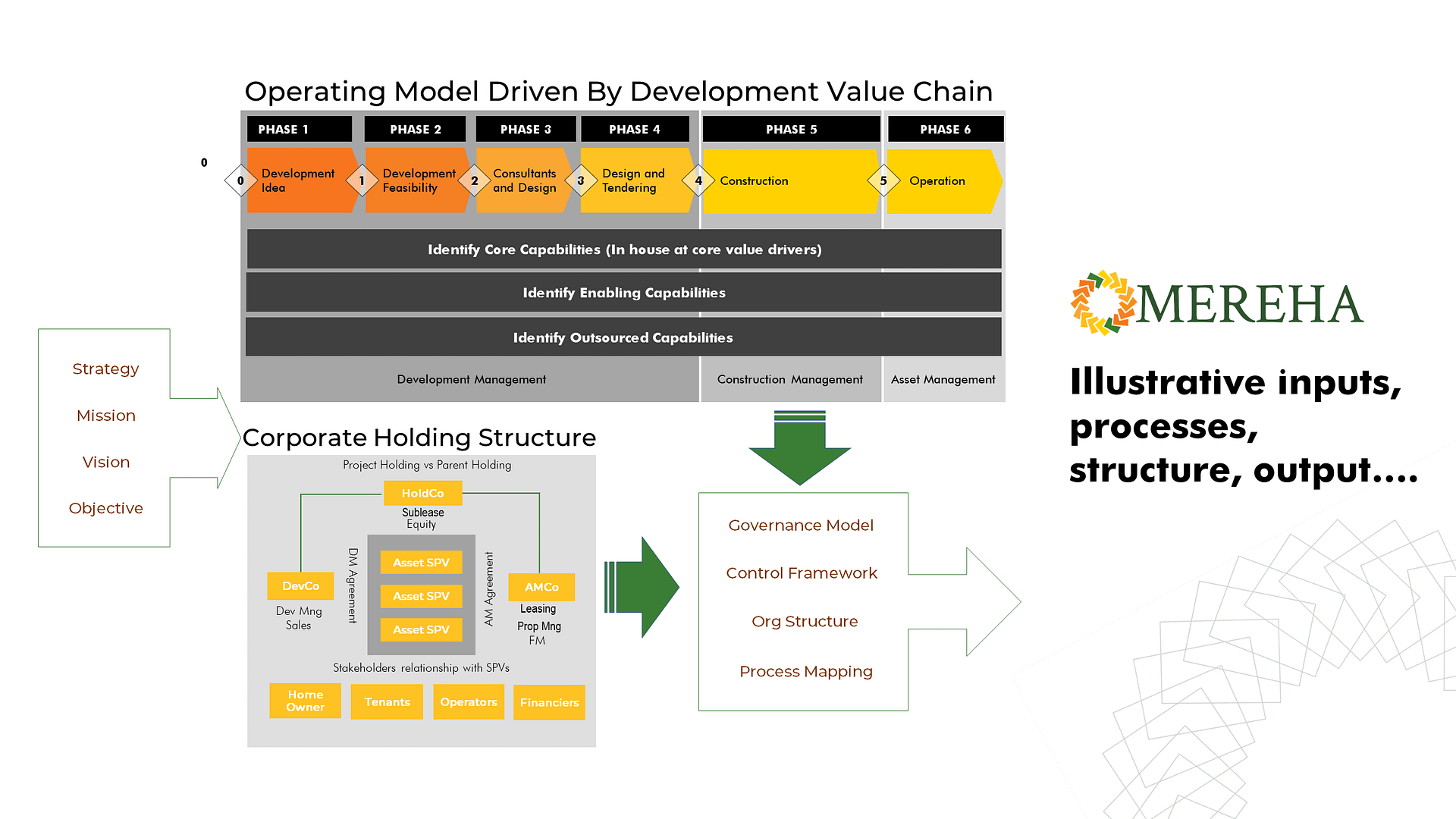

- Advice on portfolio strategy and associated business plans.

- Advice, supervise, monitor and review strategic plans at asset and portfolio level.

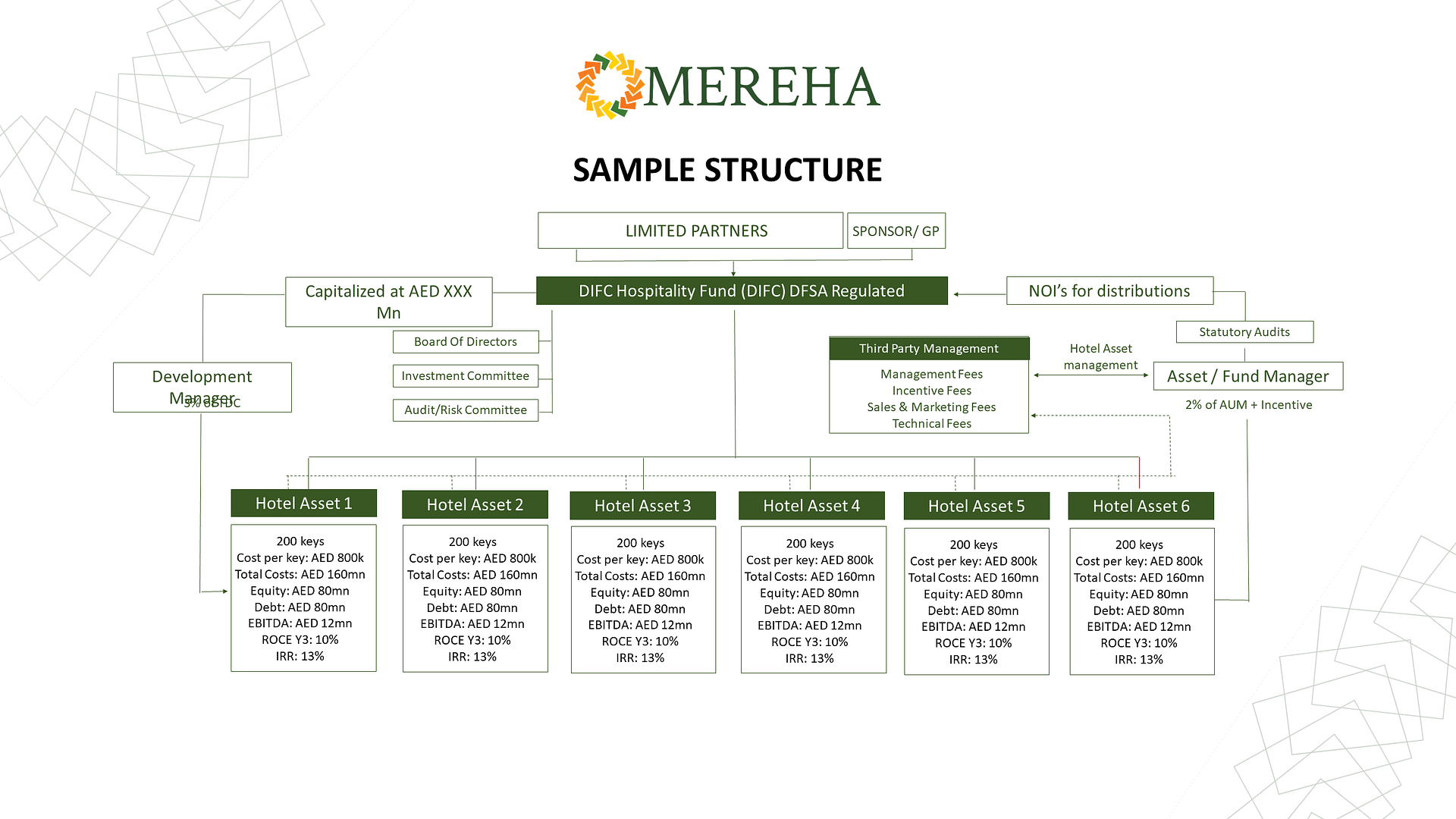

- Advice optimal capital structures at asset and portfolio level.

- Advice and review corporate and asset level organizational structures, operating models and governance frameworks.

- Advice on asset or portfolio exit strategies (JV’s, fund structure, asset disposals).

- Advice and sourcing of corporate and asset level debt and equity partners.

- Advice and execution of establishing independent hotel management companies.

2 Acquisition Advisory

- Advice and definition of acquisition strategies and targets in accordance with clients investment size, return and risk requirements (development and asset targets).

- Advice, identify, and manage due diligence process and deal teams, engage and manage, as applicable and required third party service providers.

- Advice, prepare and review investment financial models and investment memorandums.

- Advice and support in negotiating transactional documents.

- Advice and identify debt sources and equity/development partners.

- Advice and identify suitable operating partners.

- Advice and support in acquisition vehicle structuring.

- Support and manage close out of conditions precedent.

- Non – Executive director services for acquisition vehicle SPV’s and Holding Companies.

- Support in identify and implement post acquisition asset integration.

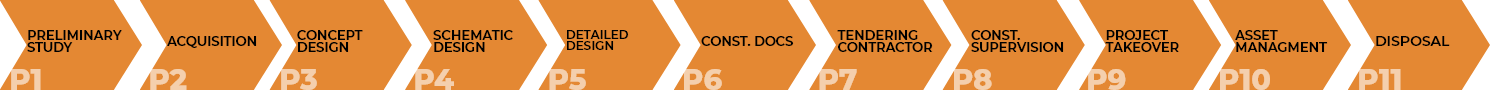

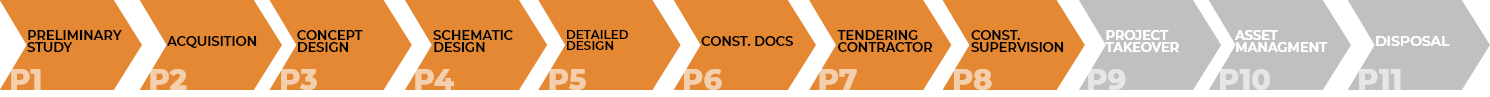

3 Design And Development Management

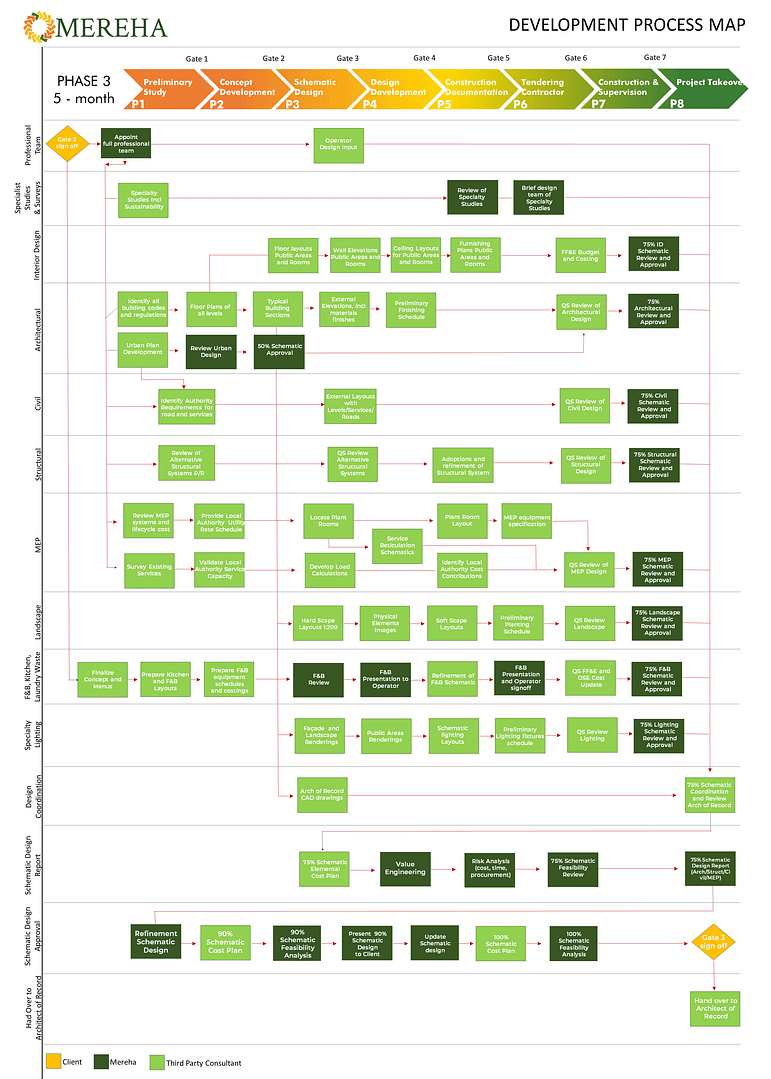

- Adoption of a proven and tested development gateway aimed at ensuring appropriate risk management throughout the development process.

- Definition of development vision and strategy, including formulations of development and design briefs.

- Advice, review and supervise development feasibility studies, development budgets and investment appraisals for internal and external purposes.

- Advice, identify, appoint and manage project consultant teams and development team structures.

- Supervision and management of design documentation aimed at identifying value enhancement opportunities and ensure that operational requirements are met.

- Advice on appropriate holding and capital structures.

- Source and identify debt and equity partners.

- Advice, manage and monitor development and project teams.

- Selection and supervision of contractor.

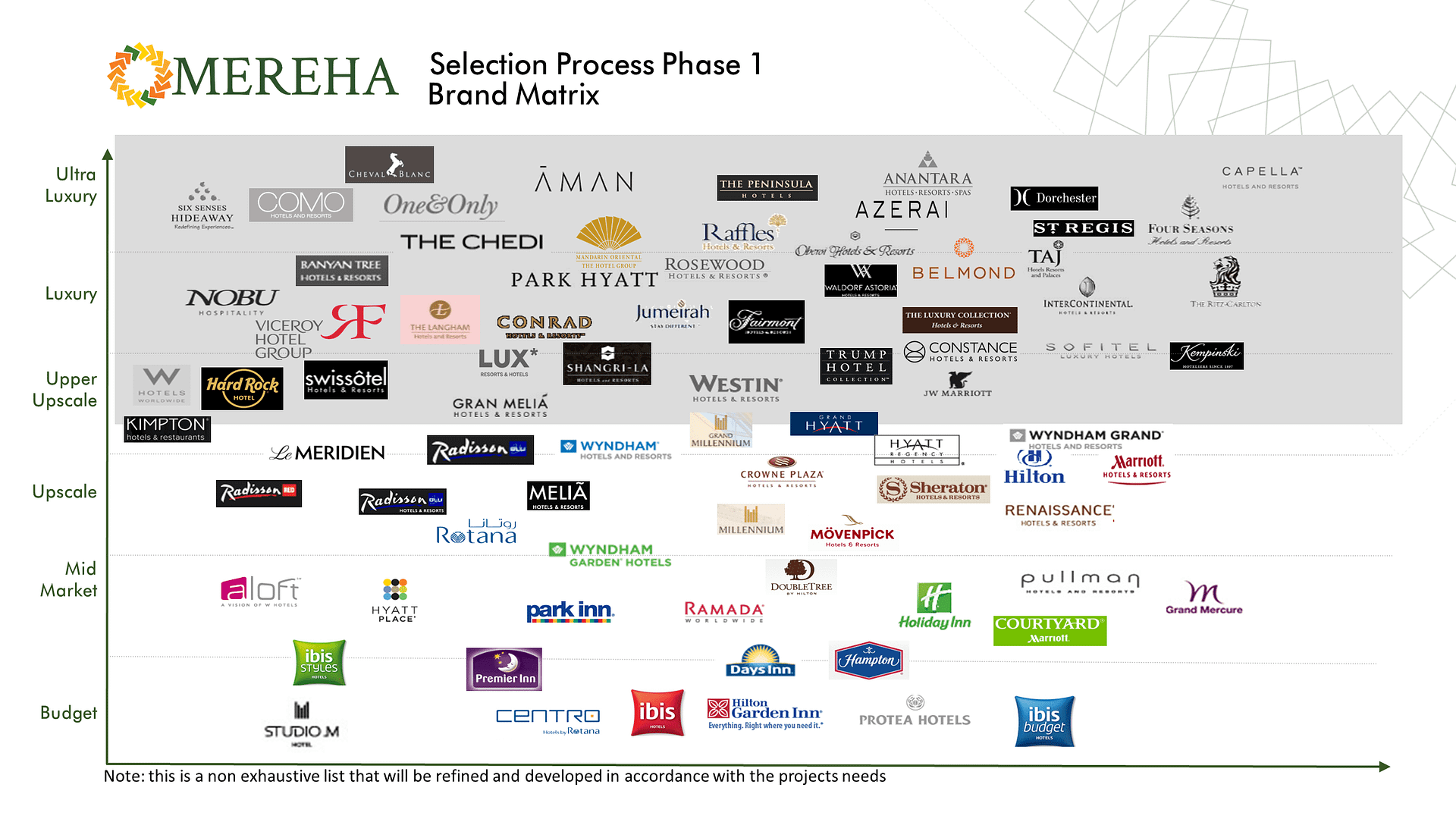

4 Hotel Operator Selection

- Adopting our proven and tested policies and procedures for the operator selection process ensures a highly competitive environment that seeks to improve owner protection and to enhance asset value through both commercial and legal negotiations.

- Applying the knowledge and experience gained internationally from having successfully negotiated hotel management agreements with multiple international hotel operators we adopt international best practices, tailored to meet our client’s requirements in the tendering, negotiating and selection of the right operator for the hotel.

- A panel of qualified legal counsels that we have previously engaged can be quickly identified to support the legal negotiations of Hotel Agreements.

- We always seek to align the process with the development program to ensure that risks are identified and appropriately managed.

5 Pre-Opening Management

- Advice and review pre-opening critical path / check list.

- Review, negotiate and advice pre-opening and first year operating budgets.

- Review and advice of FF&E and OSE installations and procurement.

- Advice and support during interview process for proposed key hotel staff.

- Review, monitor and advice in relation to required operating licenses.

- Support and advice during commissioning phase / ‘snag list’ preparations.

- Advice and support in establishing fixed asset register with appropriate account mapping .

- Ensure contract compliance.

7 Disposal Advisory

- Advice and development of disposal strategies in function of the assets strengths, weaknesses and outlook to support our clients in making informed sell vs hold decisions.

- Advice on sell strategy, including advice, identification of and management of suitable and appropriate deal team.

- Advice and supervise the production of compelling marketing materials and investment memorandums for the asset / portfolio.

- Subject to sell strategy, support our clients with the marketing of the asset

- Review and identify potential buyer types and targets

- Advice, support and negotiation of MOU’s and sales and purchase agreements (“SPA’s”)

- Support in closing out post closing conditions precedents